Legal structuring

The following legal structure is for reference purposes only. As a protocol participant, you are responsible for complying with relevant laws and regulations in your jurisdiction. Your are encouraged to consult you own tax and legal counsels.

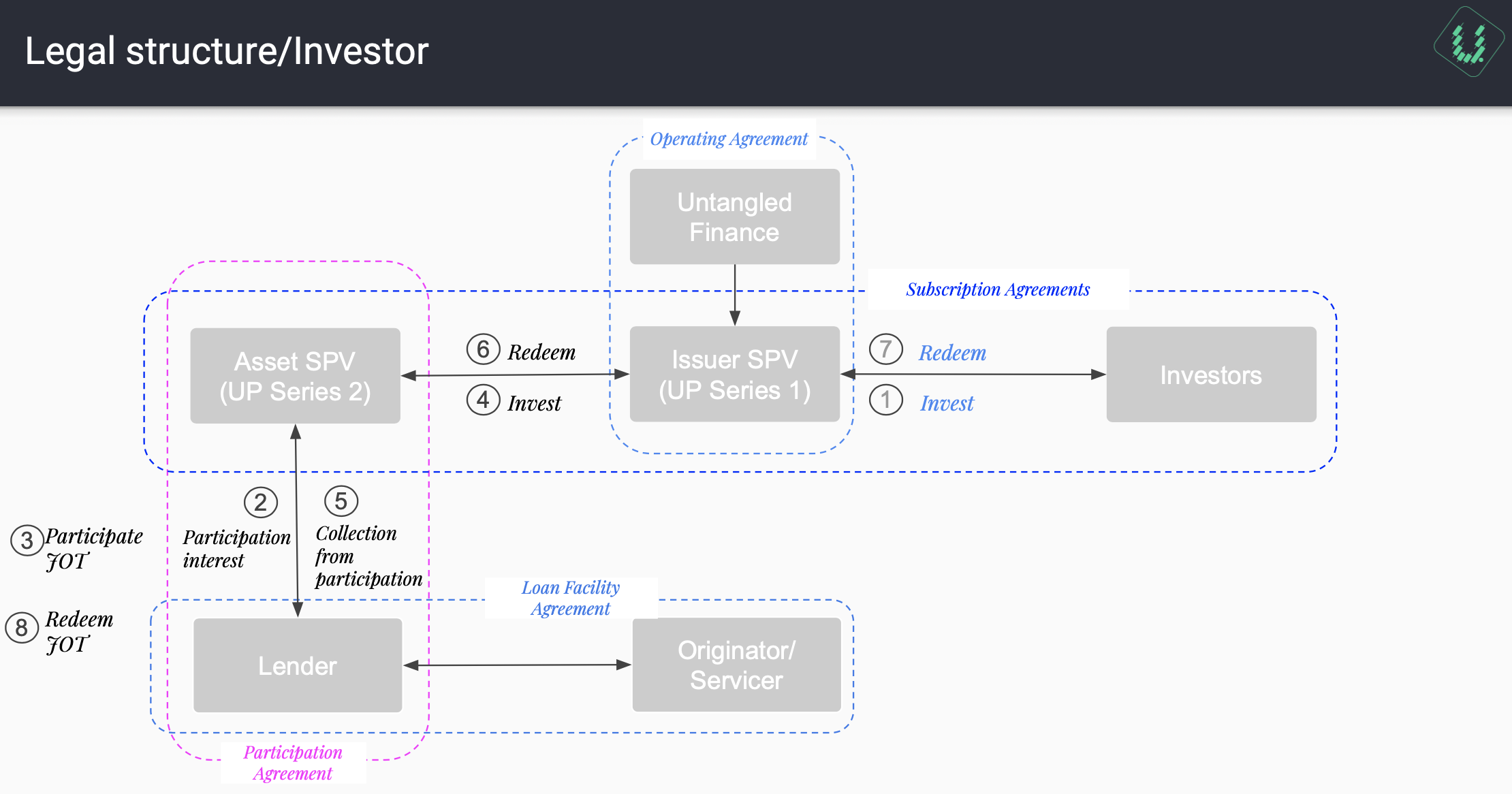

Legal structure

Issuer SPV issues tokens to Investors under US Reg D 506c. Both Issuer SPV and Asset SPVs are Series of Up Series LLC (Delaware)

Originator sells participation interests to UP Series 2 (Asset SPV)

Originator (or other investors) subscribe to junior tranche/retain junior interest in the assets

Asset SPV borrows from Issuer SPV using eligible assets as collateral.

Originator repay participation interests + interest directly to SPV’s locked box (bank account or wallet)

Asset SPV repay principal + interests to Issuer SPV

Issuer SPV makes redemption to Investors

Asset SPV redeems junior tranche to Originator

Documentation

Last updated